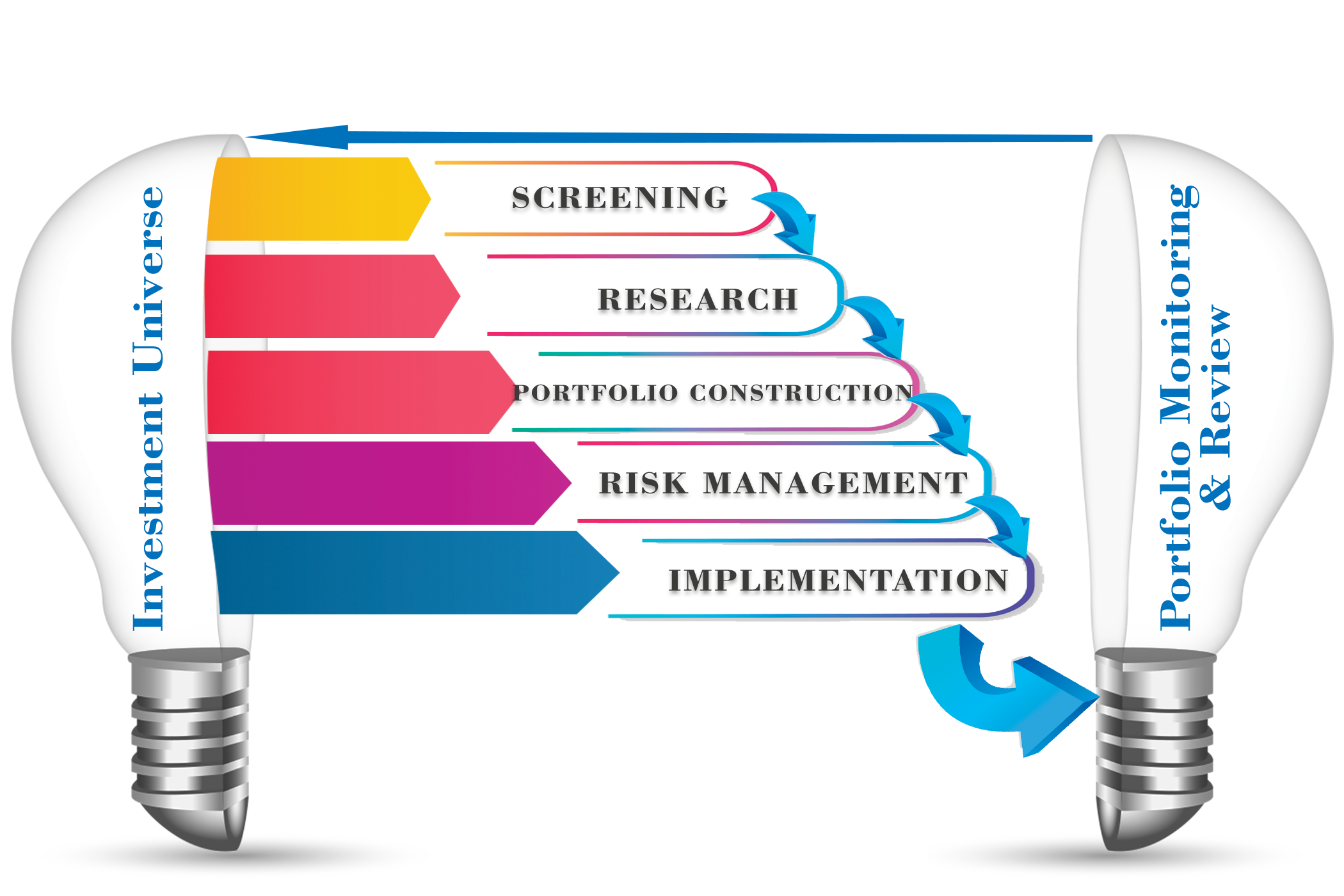

Our Investment Process

Your success starts here.

Screening

PVAM carries out extensive quantitative and qualitative screening of investment securities, holding daily meetings to discuss opportunities and allocate tasks.

Research

Rigorous due diligence covering management strength, balance sheet, earnings quality, industry structure, and ESG review, along with extensive bottom-up valuations.

Portfolio Construction

Recommended securities are considered based on top-down views, portfolio characteristics, sector correlation, and monthly reviews to ensure oversight.

Risk Management

Continual assessment of macro-economic conditions and investment performance, with scenario analysis to monitor changes in clients' liquidity needs.

Implementation

Involves asset allocation and security selection to construct and rebalance client portfolios as needed, incorporating new investment vehicles.

Stock Market Portfolio Management

We offer discretionary (DS) and non-discretionary (NDS) stock portfolio management, focusing on fundamental research and extensive macro, technical, and quantitative analysis.

- PVAM do equity investment based on fundamental research entails evaluating company earnings growth.

- Our team of analyst do extensive macro, technical and quantitative analysis to identify better buy, hold and sell stocks.

- PVAM relies on other types of research to assess market trends. Our macro analysts focus on broad economic measures, including interest rates, inflation, employment, and the money supply.

- Our technical analysts use stock price charts to capture market developments.

- PVAM Quantitative analysts develop models to gain a deeper understanding of the portfolios, to identify the risks within, and to generate investment ideas. With access to this complementary information, the portfolio managers exercise their independent judgment in making their investment decisions.